What is Insrt Finance?

NFT Finance is an area that is receiving a lot of attention from investors recently. Recently, the Blur project, a MarketPlace conducted an Airdrop, bringing excitement and excitement to users.

Before learning about Insrt Finance - a piece in the NFT Finance ecosystem, everyone can read this article to better understand NFT Finance.

Insrt Finance is a platform that helps users earn profits by depositing money into Vaults, then the platform will use these Vaults to optimize profits for users.

Vault on Insrt Finance platform will have the following main components:

- Deposit Mechanism: This is a feature that allows users to deposit their assets into the Vault in exchange for ERC-20 or ERC-721 assets representing their proportional stake in the Vault. The deposit mechanism is responsible for minting this asset.

- Vault Pool: Contains a smart contract that stores user-deposited assets. The assets in the Vault Pool are used to execute the strategy associated with the Vault.

- Asset Initialization: This is a feature that allows the Vault to acquire financiable assets, such as NFTs. The asset initialization mechanism may involve the purchase of an NFT from the NFT collection.

- Wrappers: These are smart contracts responsible for executing the strategy associated with the Vault.

- Oracles: These are external data sources used by Wrappers to manage risk and optimize returns.

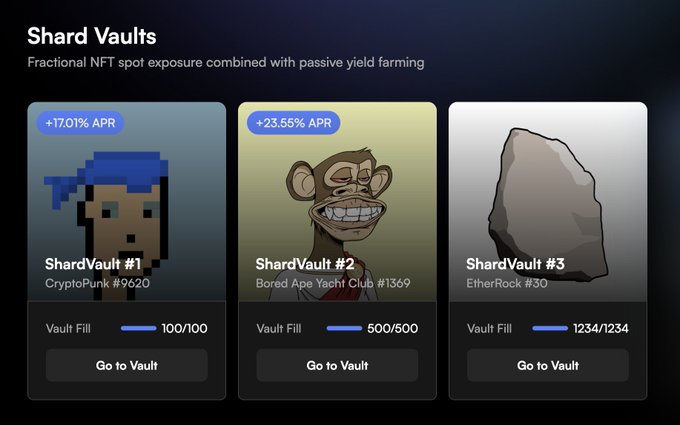

At the moment, Insrt Finance has just introduced ShardVaults as the first product on its platform. ShardVaults allows users to become part owners of Bluechip NFT and earn a return on their investment.

What is ShardVault?

To better understand we will go into the operating model of ShardVaults:

ShardVault's operating model

ShardVault's operating model

The ShardVault operating model is implemented in the following steps:

Step 1: User will deposit ETH into ShardVaults until the required amount is reached. Insrt Finance mints 1 NFT representing the user's stake in ShardVaults.

Step 2: Once the required amount has been reached, Insrt Finance proceeds to buy NFTs on MarketPlaces.

Step 3: NFT is then mortgaged on NFT Lending platforms such as: JPEG'd, the borrowed money is sent to Yield Farming platforms to earn profit.

Step 4: ShardVault automatically manages loan positions by monitoring risk, making loan payments and borrowing more as needed to prevent liquidation but also maximize profits for users.

Step 5: Users can claim their interest generation periodically from ShardVault.

Step 6: The shard holder can propose a vote to close the Vault and sell the NFT, such as if the price of the bluechip NFT rises significantly. If the vote passes, Vault will sell the NFT and distribute all the profits to Shard holders.

What Is The Difference Of Insrt Finance?

With ShardVault, users can become a co-owner of an NFT Bluechip at a much lower cost than buying an NFT. In addition, they can optimize the return on their investment.

In the future, Insrt Finance is aiming for a platform where users can create and manage their own Vaults.

Investor

02/03/2023: Insrt Finance announces a successful $2.2M fundraising led by Hashkey Capital and Infinite Capital. There are also a number of other funds participating in this investment round, including: Apollo Capital, Three Sigma, Caballeros Capital,...

Tokenomics

The project has not launched an official token yet. Some of the information disclosed by the project is as follows:

Token name: INSRT

Token Allocation

Insrt Finance Token Allocation

Insrt Finance Project Information Channel

Hope the above information has helped you to understand somewhat about Insrt Finance . NFT, previously considered only a collection, now has many applications. Inst Finance is sparking the strong development of NFT Finance and I firmly believe that NFT Finance will grow even stronger in the future.