During the month of June, the crypto market will grapple with a significant drop in trading volumes, a liquidity crunch, and increased selling pressure.

Major exchanges, especially Binance, experienced a drop in trading volume. Meanwhile, low liquidity can negatively affect price stability and market efficiency, while high selling pressure is pushing Bitcoin price down.

Reduced trading volume: opportunity for investors with confidence

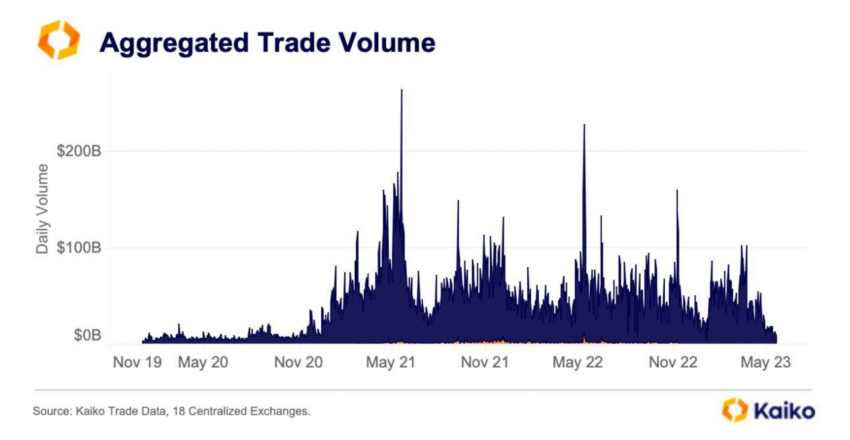

In the first quarter of this year, the trading momentum and expectations of the crypto market were high, but since then, trading volumes across all major centralized exchanges have seen a worrying decline. .

In May, total daily trading volume fell from an impressive $23 billion to $9 billion. This downtrend shows that speculation is decreasing and investors are becoming more and more indifferent to the market.

Daily crypto trading volume is now at its lowest level since 2020. The market as a whole is in a period of lethargy and suffering from time to time. The fact that the majority turns away from the speculative trend will create opportunities for those with strong beliefs"

Analyst Will Clemente said

Crypto trading volume. Source: Kaiko.

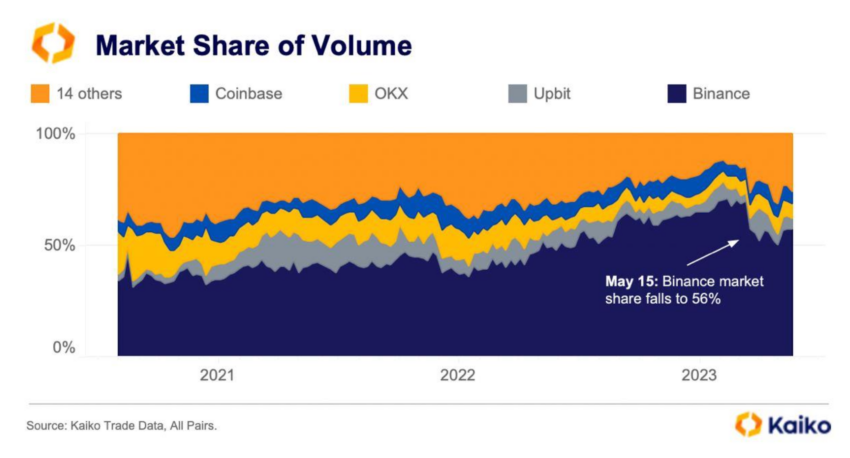

In terms of overall trading volume breakdown by exchange, Binance experienced a slump. Their market share has dropped to 56% - down 15% from its peak in the second half of 2022.

In contrast, Binance's bad luck is an opportunity for other exchanges like Huobi, Kraken, and Kucoin.

Crypto market share. Source: Kaiko

With the regulatory landscape in the US still in the dark, foreign exchanges are maintaining their dominance in the crypto trading ecosystem. They account for 86% of the entire trading volume. This trend is expected to increase further.

Notably, even Coinbase, which is generally recognized as an effective alternative to other crypto exchanges, has announced its overseas derivative product - Coinbase International Exchange.

Crypto liquidity crisis

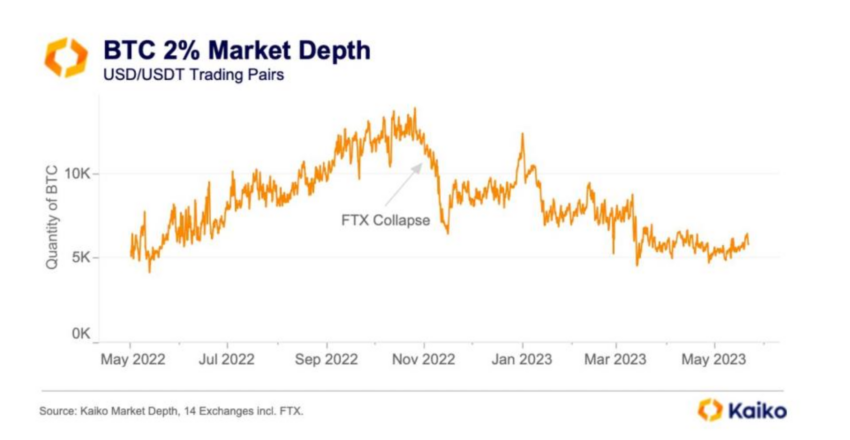

The second major problem that has cast a shadow over the crypto market is the liquidity crisis. This is especially serious for Bitcoin and Ethereum.

Although the crypto market depth (Crypto Market Depth) in USD remains stable. Liquidity is unchanged as measured with a 2% market depth in coins/tokens, meaning the depth of bid and ask prices is within 2% of the current trading price.

Cryptocurrency market depth. Source: Kaiko.

The ongoing drop in liquidity led to Jane Street and Jump Crypto, two market makers, revealing plans to scale down their crypto operations in the US due to regulatory uncertainties. Jane Street went even further, announcing a global downsizing of crypto operations.

The reduction in liquidity in the crypto market makes a lot of sense. Liquidity is an important aspect of any financial market, including cryptocurrencies. It talks about the ability of an asset to be easily bought or sold in the market without affecting the price of that asset.

High levels of liquidity create safe and efficient markets. Thus, allowing investors to enter and exit trades more easily. On the contrary, low liquidity can hinder the ability of investors to execute large trades, when they are subject to sharp price slippage.

In fact, if a trader wants to sell large amounts of crypto but not enough buyers, the price may have to drop to make the deal attractive. This process can create a downward spiral, leading to lower and lower prices and triggering a sell-off.

Selling pressure increases

The next problem that emerged in June was increased selling pressure as Bitcoin dropped below $27,000.

While the crypto community has always kept a close eye on Bitcoin's key price levels, concerns about liquidity have been amplified following legislative actions in the US.

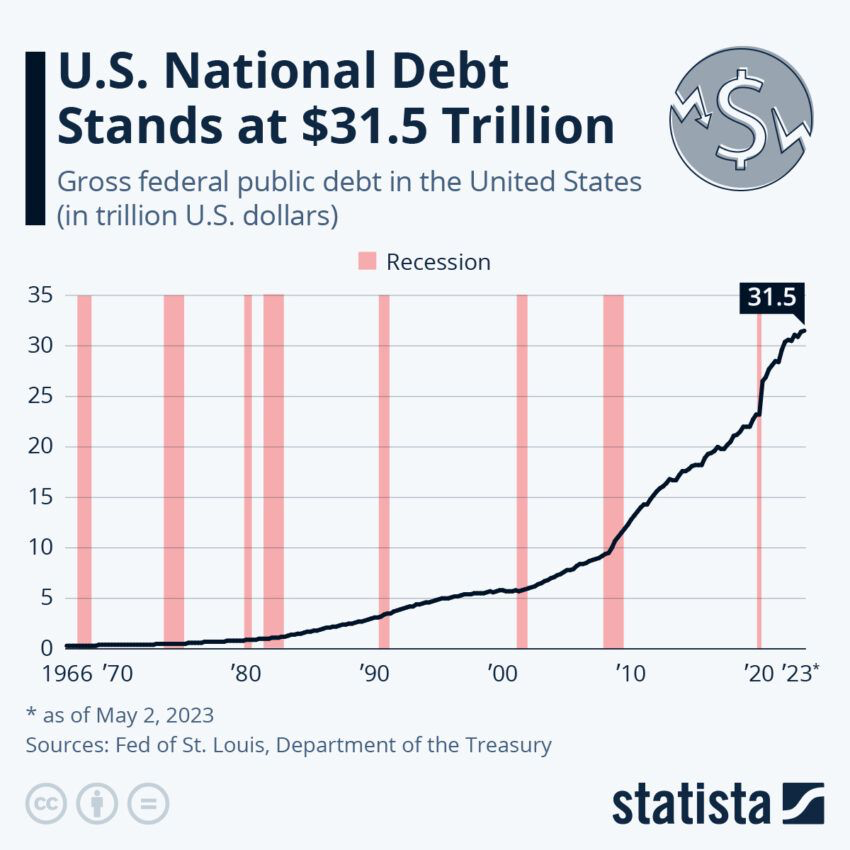

"This June, Bitcoin faces some potential difficulties as the dramatic public debt ceiling situation appears to be over. Once the Senate is able to back the debt limit law, the market will face a wave of Treasury bill issuance, which will likely cause liquidity to flow out of risky assets like Bitcoin."

Antoni Trenchev, managing partner of crypto lending company Nexo

The US public debt ceiling. Source: Statista.

Recently, the US House of Representatives passed an agreement to suspend the public debt ceiling of 31.5 trillion USD. This could lead to the issuance of up to $1 trillion in US Treasury bills, putting further pressure on Bitcoin.

However, Maartunn, Community Manager at CryptoQuant, believes that despite the recent spike in selling pressure similar to previous sell-offs, Bitcoin could soon peak and bounce back.