- It’s TradFi vs crypto as Gensler takes on Armstrong in litigation with ‘huge impact.’

- SEC lawsuit may cripple Coinbase if agency wins judgment that all cryptocurrencies are securities.

- Investors caught in the middle as two visions for crypto collide in case.

It was not a great week for Coinbase. US regulators slapped the crypto exchange with a lawsuit that could put it out of business and its share price lost a fifth of its value in a single morning.

What’s more, the company, which has more than 100 million customers and $680 million in daily trading volume, is now the target of legal action that may determine the future of the US cryptocurrency industry.

Yet for Brian Armstrong, Coinbase’s outspoken co-founder and CEO, it may be exactly what he wanted.

Special treatment

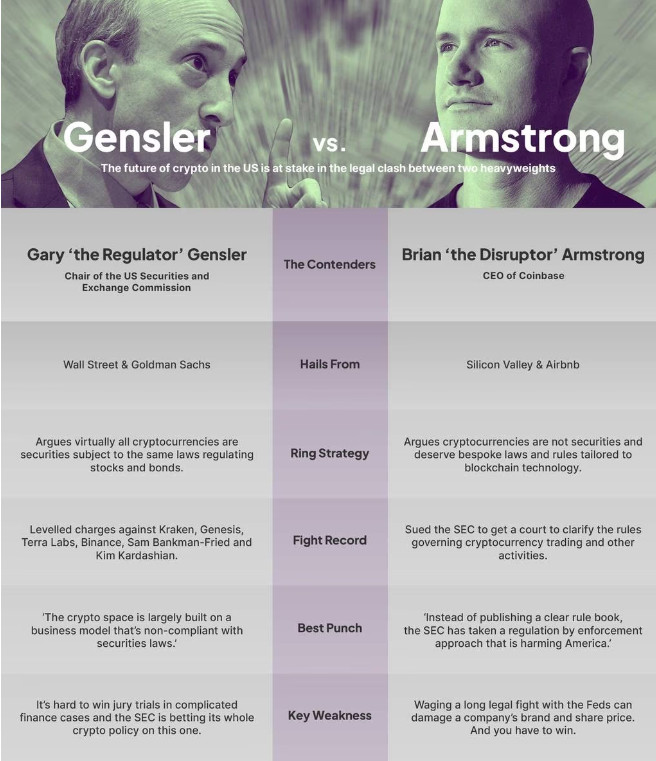

Armstrong has long championed blockchain-based assets as a unique, and unprecedented, innovation in finance that deserves special treatment from regulators. Now Armstrong will finally get a showdown with an adversary who believes the opposite — Gary Gensler, the equally outspoken chair of the US Securities and Exchange Commission.

The case pits a TradFi stalwart — Gensler is a former partner at Goldman Sachs — against a Silicon Valley disruptor. It is poised to establish once and for all if cryptocurrencies are securities covered by existing law, as Gensler argues, or novel instruments that require their own special laws and rules, as Armstrong contends.

It’ll be up to a jury to eventually decide who is right. But it won’t only be matters of law up for judgement. The case of Securities and Exchange Commission vs. Coinbase Inc. will also decide which vision will shape the evolution of a market now worth $1.1 trillion in the years to come.

Will it be Gensler’s “wild west” where crypto players thrive on “non-compliance” of the law and ripping off investors? Or will it be Armstrong’s “new financial system” that fosters “economic freedom” for a 21st century world that values decentralisation?

Investors, not to mention the founders, devs, and users in the crypto and DeFi communities, are caught in the middle.

(Andrés Núñez)

Straight away, the case raises big questions about the fate of the world they love: If digital assets are deemed to be the same type of investment products as stocks and bonds, how will the likes of Ethereum and Solana and Cardano and other blockchain networks and DeFi protocols comply? What happens if they don’t?

“If everything except Bitcoin are securities, and then everybody that touches them needs to be licensed and shoved into the TradFi architecture, it’s going to slow down innovation in the US around blockchain,” Timo Lehes, the co-founder and managing director of Swarm Markets, a regulated crypto exchange in Europe, told DL News. “It will have a huge impact if Coinbase is forced down this path.”

Harming America

No surprise, Armstrong and his management team feel hard done by. Coinbase has denied it violated securities laws, and in a tweet Armstrong criticised the SEC for failing to publish “a clear rulebook” for the crypto industry. “The SEC has taken a regulation by enforcement approach that is harming America,” he said.

He believes this so utterly that Coinbase even petitioned a court to compel the commission to propose new rules for digital assets. The court has given the agency until Tuesday to provide some answers.

‘If everything except Bitcoin are securities, and then

everybody that touches them needs to be licensed

and shoved into the TradFi architecture.’

— Timo Lehes

Meanwhile, Crypto Twitter is crackling with anger and defiance by leading crypto voices.

“The outrage is justified,” tweeted Jake Chervinsky, the chief policy officer at the Blockchain Association, the top industry lobbying group in Washington. “For years the SEC has refused to give useful guidance or engage in productive rulemaking. This is ridiculous.”

Nonsense, said John Reed Stark, the former head of the SEC’s Office of Internet Enforcement. “My take is that the SEC is spot on with their crypto-related enforcement efforts,” he tweeted. “No matter what the carnival barkers promise, it is axiomatic that crypto trading platforms are high-risk, perilous and inherently unsafe.”

Coinbase is not some fly-by-night operation domiciled in the Bahamas. It’s a listed company on the Nasdaq with influential venture capitalists Marc Andreessen and Katie Haun on its board. The exchange’s core business lets investors buy and sell Bitcoin, Ether and other digital assets for transaction fees. In the first quarter, Coinbase recorded a $79 million net loss on $736 million in revenue.

Different than the Binance case

In its lawsuit filed in federal court in New York on June 6, the SEC said Coinbase “merges” three businesses that are typically separated in TradFi. The agency accused Coinbase of unlawfully failing to register a national exchange, a broker-dealer, or clearing agency, a type of firm that helps settle trades.

Unlike the lawsuit the SEC brought against Binance and its CEO, Changpeng Zhao, on June 5, the agency did not allege Coinbase committed fraud, nor did Gensler accuse Armstrong’s company of running an “extensive web of deception” as he did in the Binance case.

What has crypto experts anxious is the SEC’s decision to flag a number of widely held cryptocurrencies — Solana’s SOL, Cardano’s ADA, Polygon’s MATIC, among them — that trade on Coinbase. The agency says these investment offerings should be registered as securities.

What has crypto experts anxious is the SEC’s decision

to flag a number of widely held cryptocurrencies

— Solana’s SOL, Cardano’s ADA, Polygon’s MATIC — that trade on Coinbase.

This is huge because it means Coinbase may be barred from listing these tokens if the SEC prevails, which would severely impact their value and poleaxe Coinbase’s business. It also puts all those crypto projects on notice they are in the SEC’s crosshairs.

Can Coinbase win? Anything can happen in a jury trial, of course, which is why the SEC typically tries to settle its legal actions by getting targets to comply with its wishes and pay penalties. (In February, the crypto exchange Kraken agreed to pay a $30 million settlement with the SEC and pull the plug on its staking-as-a-service business).

In contrast to the Binance case, which will probably turn on facts and evidence, the Coinbase matter is about the interpretation of the law, say legal experts.

A veteran litigator and crypto lawyer at an influential digital assets firm said Coinbase has a lot to work with when it comes to its defence, starting with its transparency.

“There isn’t a brazen, scofflaw attitude coming from them,” the lawyer said. “There’s actual, legitimate disagreement as to the applicability of the nation’s securities laws in this space.”

Coinbase is saying “the SEC is applying the law in the wrong way,” he added.

Beefing up compliance

Other attorneys say Coinbase may be erring by confusing a public relations strategy with a legal one. Coinbase’s marketing has always pivoted on claims that it has been beefing up its compliance. The exchange has registered with the Treasury’s Financial Crimes Enforcement Network, and holds numerous state licences. Armstrong has said publicly that Coinbase rejects hundreds of tokens seeking to list on the exchange.

Ever since regulatory scrutiny intensified in 2021, Coinbase has essentially argued it would be happy to comply with rules, as long as it likes them. “Coinbase has demonstrated a commitment to compliance,” Paul Grewal, the company’s chief legal officer, said in a statement issued Tuesday.

‘Some companies think that the SEC and

agencies in general are supposed to be

available at their beck and call.’

— Alexandra Damsker

This position strikes some legal experts as too cute by half. There’s nothing wrong with lobbying for laws you want passed but you can’t decide which to obey and which to disregard in the meantime.

“Some companies think that the SEC and agencies in general are supposed to be available at their beck and call,” Alexandra Damsker, a securities attorney and entrepreneur who specialises in blockchain law.

“Just because you’re well-known in a space doesn’t mean you’re entitled to anything.”

As much as the SEC-Coinbase fight is about the law, so, too, is it a clash between two headstrong players who refuse to budge from their positions.

At the age of 30, Gensler became the youngest person to ever make partner at Goldman Sachs, a coveted perch on Wall Street that bestows influence, prestige, and a springboard for public service.

Gensler advised Hillary Clinton’s 2016 presidential campaign and served as chair of the Commodity Trading Futures Commission before President Biden nominated him to lead the SEC in 2021. Unlike his predecessors, Gensler actually understood how blockchain technology worked, having taught a course in the subject at MIT’s Sloan School of Management.

Outside the perimeter

Any hopes he would be an ally of the crypto industry quickly evaporated as Gensler embraced the idea that digital assets were not exceptional instruments but were pretty much the same thing as stocks and bonds — products that offered investors a chance to profit from speculation in the marketplace.

From the outset, Gensler, 65, urged crypto leaders not to operate “outside the perimeter” of existing securities laws. That idea didn’t sit well with Brian Armstrong at all.

The 40-year-old billionaire got his start as an intern at IBM before winding his way through Deloitte & Touche and Airbnb. He co-founded Coinbase back in 2012 when Bitcoin was still the domain of cypherpunks and SEC regulation seemed absurd.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/dlnews/OUAY4C7QGRFTJDOCTLZBPLB7CQ.jpg) Coinbase lets investors buy and sell cryptocurrencies like BTC on its phone app. (rarrarorro/Photo credit: Shutterstock)

Coinbase lets investors buy and sell cryptocurrencies like BTC on its phone app. (rarrarorro/Photo credit: Shutterstock)

He hasn’t been shy about venting his frustration. In a 21-piece Twitter thread in September 2021, Armstrong decried the “really sketchy behaviour” coming out of Gensler’s SEC. He rejected the idea that everything could be solved if crypto players just registered their offerings with the SEC.

“There is no path to ‘come in and register’” - we tried, repeatedly,” he tweeted on June 6.

Hester Peirce, one of the SEC’s five commissioners, has long said the registration process idoesn’t work.

“In the current climate, crypto-related offerings are not making it through the SEC’s registration pipeline,” she wrote in a statement published on the commission’s website earlier this year.

On Thursday, Gensler pushed back. “I disagree with the notion – and recent history disproves it – that crypto intermediary compliance isn’t possible,” he said in a speech at an industry event.

Both sides dig in

As for what comes next, there will be a spate of pre-trial hearings and undoubtedly more sabre-rattling as both sides gird for the battle to come. Yet something may already be changing — a recognition that crypto must evolve if it’s to solidify as a bona fide new asset class whether its offerings are “registered” or not.

“We have an abject lack of accountability,” said Damsker, the securities lawyer. “This is just endemic in this space. Maybe it’s because we embrace the idea of anonymity. We’re just not accustomed to being held accountable for what we are doing, and it’s so much easier to blame the government.”