Bitcoin, Ethereum, Dogecoin Mirror Stock Market Rout — Major Coins Crash As Recession, War Fears Grip Investors: Analyst Says Aug, Sept 'Worst Months' for King Crypto But Oct Raises Hopes

In a dramatic turn of events, the cryptocurrency market experienced a significant downturn on Sunday, driven by mounting concerns of a recession and escalating geopolitical tensions. This tumultuous turn of events marked the most severe intraday decline for the risk-on sector since 2024.

Bitcoin, the leading cryptocurrency, plummeted to an intraday low of $52,559, a level not witnessed since late February. Although it managed to regain some ground during the volatile trading session, reaching $54,000, it still suffered a 10% drop within the past 24 hours.

Ethereum, the second-largest cryptocurrency, experienced its sharpest decline since December 2022, hitting an intraday bottom of $2,152. Its value tumbled by a staggering 20% over the course of the last day, making it one of the market's biggest losers.

During this tumultuous period, the market witnessed liquidations totaling $775.89 million, with $665 million in bullish bets being wiped out. As a result, the global cryptocurrency market plunged below $2 trillion for the first time since February 25, experiencing an 11.50% slump within the past 24 hours.

These cryptocurrency sell-offs coincided with a slump in Japan's stock market, as the blue-chip Nikkei 225 plummeted by over 5% following Monday's market opening.

The bleeding continued in the U.S. stock futures market on Sunday night, with the Dow Jones Industrial Average Futures dropping by 300 points, or 0.75%, as of 9 p.m. EDT. Futures tied to the S&P 500 tumbled by 1.39%, while Nasdaq 100 Futures experienced a dip of 2.33%.

These downward trends in the stock market followed a week of losses, as investors grew increasingly concerned about a potential recession after a report revealed high unemployment rates on Friday.

Adding to the mounting unease, escalating geopolitical tensions in the Middle East and the looming threat of a full-blown war further spooked investors.

In light of these events, esteemed cryptocurrency analyst and trader Ali Martinex highlighted historical patterns, noting that August and September have traditionally been the worst months for Bitcoin, with average losses of -7.82% and -5.58%, respectively. However, October has historically brought hope, boasting average gains of 22.90%.

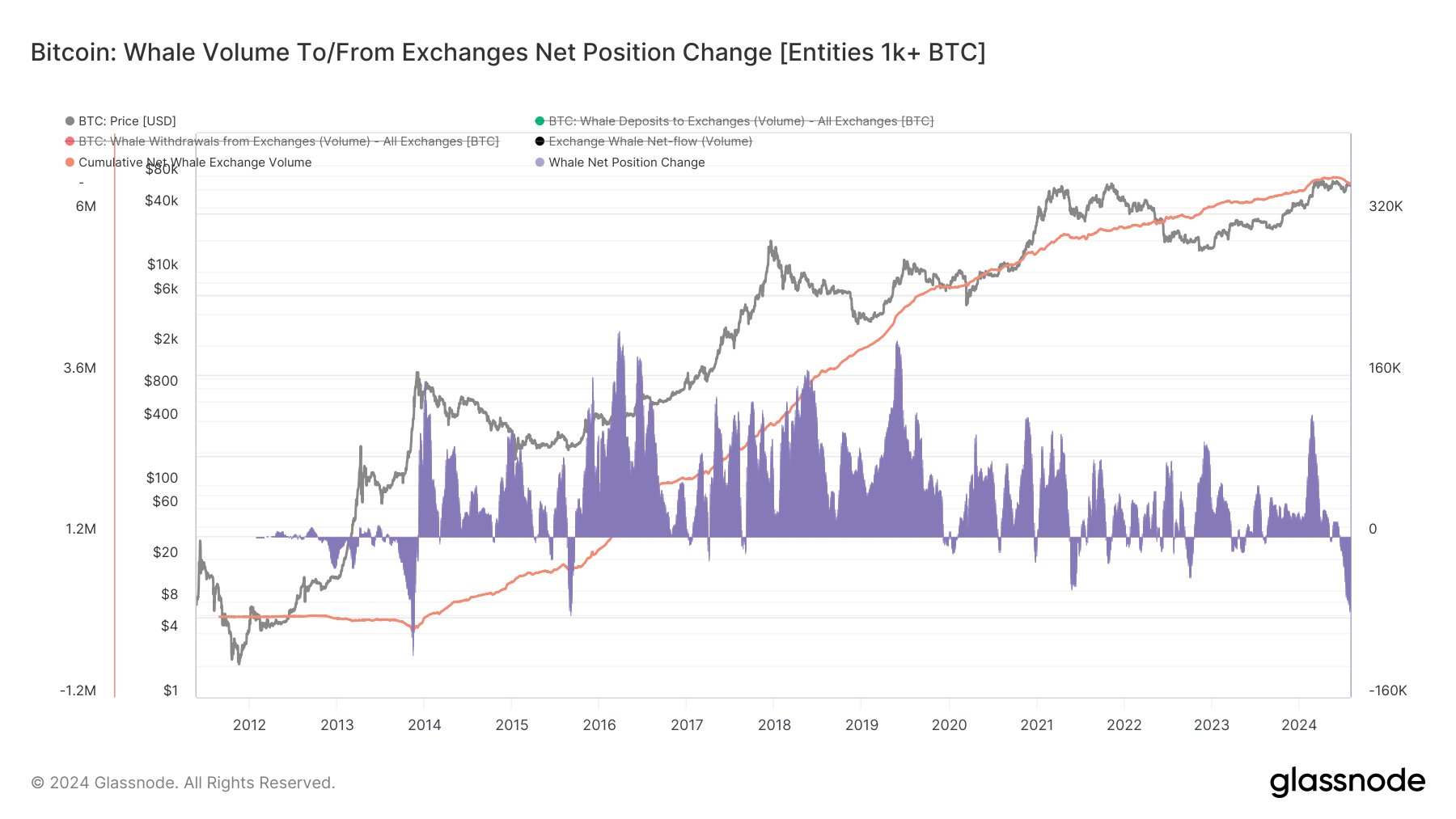

Interestingly, while the market experienced a downturn, whale investors seized the opportunity to accumulate Bitcoins in large quantities. CryptoRus, a prominent account in the cryptocurrency space, revealed that over the past month, more than 64,000 BTC, valued at $3.5 billion at the time of writing, were withdrawn from exchanges. This marked the most significant movement of this kind since 2015.